Open enrollment is the time period each year when you’re allowed select your company benefits. This is a great time to review your options and make sure you’re taking full advantage of what your company offers. Open enrollment season is usually in the fall and you select benefits for the following calendar year. Some companies have open enrollment seasons during other times of the year, and your benefit period does not match the calendar year. Regardless of when your open enrollment period begins, you probably receive a multi-page document that explains all the options available to you as an employee. The terms and details can be confusing even if you consider yourself financially savvy. In this two-part series, I will cover the most common employee benefits, and several lesser-known benefits. We’ll start with the most confusing benefits: health insurance and the many accounts that can be used to cover medical expenses.

Health Insurance

Before I explain how to choose which health insurance policy is best for you, it’s crucial to understand some basic health insurance terms. The most basic term, premium, is the amount that’s deducted from your paycheck to maintain your health insurance coverage. Other common terms include:

- Deductible – What you must pay before insurance kicks in

- Copayment (or copay) – A fixed amount you pay each time you go to the doctor

- Coinsurance – The percentage you pay after you meet your deductible, but not the out of pocket max

- Out-of-pocket maximum – The most you’ll pay each year including your deductible, copay, and coinsurance

You may have heard the terms “PPO,” “HMO,” and “High Deductible Health Plan” (HDHP). This article covers these major types of health insurance and considerations for each. It also explains the common terms above in more detail. Your employee benefits guide should explain the differences between each plan your company offers and how much each plan costs. Generally with any insurance, a high deductible means a lower premium and low deductible means a higher premium. Sometimes the difference in premiums is drastic. As an incentive, many companies offer HDHPs at no cost to employees. Another incentive for the HDHP is a company contribution to your HSA. The amount varies by company.

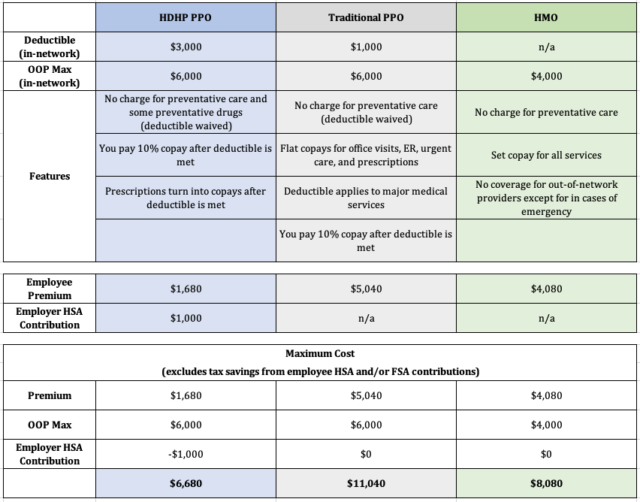

Now that we have the basics out of the way, how do you know which plan is best for you? Here’s a simple, real-life example:

When you compare the premiums for each plan, the HDHP is significantly less than the Traditional PPO and HMO plans. Also, the out-of-pocket maximum (your total exposure) is the same for the first two plans. Finally, the company makes a $1,000 contribution to your HSA. In a worst-case scenario (such as a major medical event), the HDHP comes out on top.

HDHPs work best in two extreme scenarios: when you hardly use your health insurance and when you have significant medical expenses. If you’re somewhere in between and you’re likely to get close to the deductible without hitting it, the HDHP feels painful. When deciding among plans, consider the following:

- Do you take several prescription medications or need to see a doctor frequently?

- Can you afford the deductible and out-of-pocket maximum?

- Are you interested in taking advantage of an HSA?

In summary, if you’re healthy and only go to the doctor for your annual exam, consider the HDHP. If you expect to go over your deductible for the year, you should also consider the HDHP. If you’re somewhere in the middle, compare the potential difference in cost between the HDHP and Traditional PPO. If you like the in-network doctors and are okay with getting referrals to specialists, consider an HMO.

Flex Spending Account (FSA) vs. Health Savings Account (HSA)

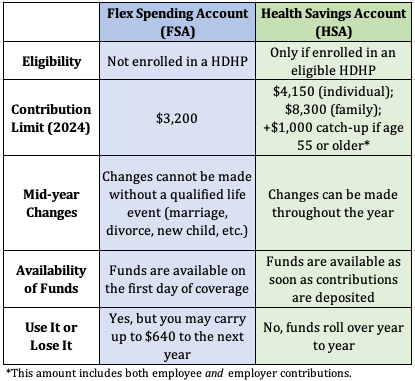

HSAs and FSAs allow you to set aside pre-tax dollars from each paycheck to pay for eligible out-of-pocket health care expenses. While there are a few nuances, here’s a basic chart that illustrates the difference between the two:

I’d be remiss if I didn’t mention the greatness of HSAs. These accounts are a powerful tool that can complement your retirement savings. First off, there’s a triple tax advantage. Contributions to an HSA are pre-tax, funds grow tax-free, and qualified withdrawals are tax-free. Like a 401(k), you can take the account with you when you leave a company or change health insurance plans. Since unused funds can roll over from year to year, you can let your savings build for future use (such as medical expenses in retirement). You can also invest HSA dollars similar to a 401(k).

If you’re eligible to contribute to an HSA and you can afford to max it out, I highly recommend it! Even better, if you can afford to pay medical expenses out of pocket, let your HSA dollars accumulate and invest them for future use.

If you don’t have a HDHP that is HSA eligible, an FSA is your only option. Contribute only what you think you’ll use for the year. If you’re unsure what you’ll use, only contribute the $610 you can carry over.

Dependent Care FSA

This is a special type of FSA that can be used for qualified daycare or other dependent care expenses. Qualified withdrawals include expenses for:

- A dependent who is younger than age 13.

- A spouse who is unable to work and care for themselves.

- Another adult dependent who is unable to care for themselves and for whom you claim the dependent on your tax return.

The maximum employee contribution is $5,000 per household ($2,500 for married individuals filing a separate tax return). This account is subject to the “use it or lose it” rule and there is no carryover to the next year. If you have small children, this is a no brainer. Max that baby out (pun intended)! Childcare expenses will be at least this much throughout the year.

Limited Purpose FSA

This is a special type of FSA that may be available if you’re enrolled in a HDHP with an HSA. Initially, limited use FSAs can only be used to pay dental and vision expenses. In some cases, these accounts can be used for regular qualified medical expenses after you meet your medical insurance deductible. Just like a standard FSA, the maximum employee contribution for 2024 is $3,200. It is also subject to the “use it or lose it” rule. If you know that you have major dental or vision work coming up, these accounts are beneficial. Otherwise, contribute the $640 you can carry over or skip it altogether.

Dental and Vision Insurance

Most companies offer basic dental and vision insurance at no cost to you. In some cases, you may have to pay a small premium. Dental and vision benefits often act more as pre-paid benefits than traditional insurance. Even if you have a large expense, such as major dental work, your insurance benefit is typically capped at $2,000 or less per year. If the coverage is not free, compare the cost of paying for these services out-of-pocket to the premiums’ cost.

In Part Two of this blog series, I cover life insurance, disability insurance, legal services, and other valuable benefits that can add up to thousands of dollars.

Need help choosing the benefits that are best for you? Let’s chat!

Did you find this post helpful? Sign up for our newsletter to receive financial inspiration, education, and updates.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Chloe Moore, and all rights are reserved. Read the full disclaimer here.