Equity compensation has become an increasingly common way to recruit and retain employees. While it was traditionally a way to award high-ranking executives, it has become common for tech employees at all levels. It can also be a lucrative part of your compensation package that helps you achieve financial goals. To get the most out of equity compensation, it’s important to understand how it works and how it fits into your financial plan.

What is Equity Compensation?

Equity compensation is a component of your total compensation. In addition to a salary, cash bonuses, and benefits, some employees may receive stock in their company. This component can be negotiated just like you negotiate at times, just like you might negotiate your cash compensation and benefits.

Types of Equity Compensation

While there are many types of equity compensation, two of the most common are stock options and restricted stock units.

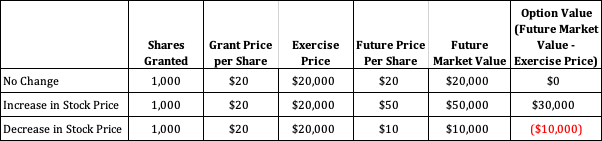

A stock option is the right to buy shares of company stock for a fixed price (known as the exercise price) during a fixed period of time (usually 10 years). There are two types of stock options: Non-qualified stock options (“NQSOs”) and Incentive stock options (“ISOs”), and they differ in their tax treatment.

The value of stock options is determined by the difference between the exercise price and the stock’s current value. If the current price of the stock is above the exercise price, the stock option has value, commonly known as “in the money.” If the current price of the stock is below the exercise price, the stock option has no value.

Example: Your company gives you the right to buy 1,000 shares of company stock for $20/share. If the stock’s current price $50/share, your option allows you to buy it for $30/share less than the market price. If the stock’s current price is $10/share, your option has no value because it’s cheaper to buy the stock in the open market.

A restricted stock unit, or RSU, is your company’s promise to give you shares of stock in the company as soon as you meet certain conditions. The most common condition is time with the company, but the condition could also be certain performance metrics. Getting an RSU is like getting a cash bonus and using that cash to buy company stock. The key difference between RSUs and stock options is that RSUs always have value as long as the company has value. As a result, the risk is higher with stock options than with RSUs.

Example: Your company promises to give you 1,000 shares of stock. To receive the shares of stock currently valued at $25,000 ($25 per share), you must stay with the company for four years.

RSUs are also subject to vesting. In this case it is the time you must wait before you own and can sell your stock. Once your RSUs vest, you will have to decide when to sell the stock.

Considerations

When deciding when to exercise or when to sell your company stock, several considerations will influence your decisions. It is important to think about your goals and how this additional income can help you. After all, equity compensation is just another form of compensation, similar to a cash bonus.

Taxes

One of the major considerations with equity compensation is taxes. With stock options, the difference between the exercise price and the stock price on the exercise date (known as the “spread”) is taxable. The tax impact varies based on whether you have ISOs or NQSOs. In addition, the difference between the value on the date you sell the stock and the value of the stock on the exercise date is taxable as a capital gain or loss. The tax impact varies based on whether the gain or loss is short term or long term.

Example: In our previous example, where the stock price at exercise was $50/share and the exercise price was $20/share, the difference of $30/share is taxable. If you later sell the stock after it has increased to $75/share, the difference between $75 and $50 is taxable as a capital gain.

RSUs are taxable as ordinary income on the day they vest, just like your salary or a cash bonus. When you sell the stock, the difference between the value on the date you sell and the value on the date you receive the stock is taxable as a capital gain or loss. The tax impact varies based on whether the gain or loss is short term or long term.

Example: In our previous example where you received 1,000 shares of company stock valued at $25/share, $25,000 is taxed as regular income. When you sell the stock, the difference between the value when you sell the stock and the value when you received the stock is taxable as a capital gain or loss.

Taxes may be withheld at exercise (for stock options) or on the day they vest (for restricted stock). In some cases, the amount withheld may not be enough, and you may owe additional Federal and state taxes on April 15th. You may also be subject to payroll taxes, which includes Social Security and Medicare taxes.

Employment Status

There are rules around what happens to your stock options or restricted stock units if you leave your job, become disabled, or die. Always read your documents carefully to make sure you understand the terms of your agreement.

Investment Risks

It is common for people to accumulate stock in their company because they don’t understand how stock compensation works or avoid making a decision. Having a large portion of your net worth in your company stock can be risky. Remember, don’t put all your eggs in one basket!

Public vs. Private companies

Public companies are companies that can be traded by the general public on stock exchanges. Private companies are generally owned and traded by the company’s founders, management, employees, or private investors. A private company can become a public company by selling all or a portion of itself through an initial public offering (IPO).

Stock options – With a public or private company, you’re eligible to exercise your stock options as soon as they vest. Some private companies allow you to exercise your stock options before they vest. This is called an early exercise and there are several factors to consider.

Restricted stock units – The main difference between public company RSUs and private company RSUs is when they fully vest. With a public company, the stock will vest as long as you work for the company for the time required or if certain performance metrics are met. With a private company, you generally have to meet the time or performance metrics, and the company must have a change in control. This change in control could mean the company goes public (IPO) or there is a merger or acquisition.

These days most public companies and late stage private companies offer RSUs and private or early stage companies offer stock options. Be careful with private company equity compensation, as it’s not always a clear winner. Not every private company decides to go public and not every IPO is a home run!

Key Takeaways

- Think of stock options and restricted stock units as part of your total compensation in addition to your salary, benefits, cash bonuses. Don’t be afraid to negotiate equity compensation just like you negotiate your cash compensation and benefits.

- Make sure you read your documents so you can understand how things work and how it impacts you.

- Consult with a qualified financial planner and tax professional who are familiar with equity compensation. They can help you understand job offers and how to best manage your equity compensation.

When it comes to equity compensation, there’s a lot to consider. Schedule a call to learn more about how equity compensation fits into your financial plan.

Did you find this post helpful? Sign up for our newsletter to receive financial inspiration, education, and updates.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Chloe Moore, and all rights are reserved. Read the full disclaimer here.